One of the most underrated and underused employee benefits for small business is a “cafeteria plan,” outlined in section 125 of the U.S. tax code. This plan allows employees to withhold a portion of their pre-tax salary to cover certain medical or child care expenses. According to the Society for Human Resource Management (SHRM), this written plan offers employees a choice between receiving their compensation in cash or as part of their employee benefits.

- These employee contributions are made pre-tax, and employer contributions towards an employee’s cafeteria-plan benefits are not taxes.

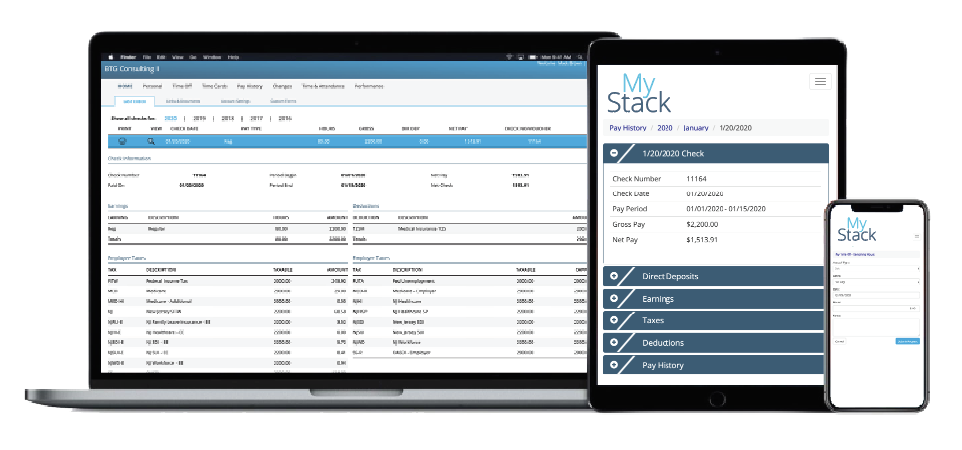

- Employees win because these benefits are free from federal and state income taxes, therefore, an employee’s taxable income is reduced—resulting in a higher take-home pay.

- Employers win by not having to pay FICA (workers’ comp premiums) on those dollars, and employees win by not having to pay FICA, federal and most state withholding taxes.

Three Specific Flexible Benefits of a Cafeteria Plan

- Pre-tax health insurance premium deductions, known as a Premium Only Plan (POP). POP plans allow employees the option to withhold a portion of their salary, pre-tax, to pay for their premium contribution for most employer-sponsored health and welfare benefit plans.

- Dependent care flexible spending account (DCA).The dependent care FSA is attractive for employees who pay for child care or long-term care for their parents. Employees may hold back as much as $2,550 if single and $5,000 if married annually of their pre-tax salary or dependent care expense. This includes expenses they pay while they work, look for work, or attend school full time.

Qualified dependent care expenses may include, but are not limited to, the care of a child under 13, summer day camps, long-term care for parents, and care for a disabled spouse or a dependents incapable of caring for themselves - Out-of-pocket unreimbursed medical expenses, known as a Flexible Spending Account (FSA).A FSA allows an employee to fund up to $2,550 of certain medical expenses on a pre-tax basis through salary reduction to pay for out-of-pocket expenses that aren’t covered by insurance. For example, this can include annual deductibles, office co-payments, prescriptions, eye care, and dental care including orthodontia. The average working American employee spends more than $1,000 annually on these types of services. By participating in a FSA, an employee’s taxable income is reduced, which increases the amount of take-home pay.

Cost or Coverage Changes Allowed

Under a cafeteria plan, says SHRM, an employee may change their election during a plan year if one of the following occurs:- The cost charged to the employee significantly increases or decreases. This includes when an employee or their spouse or dependents become eligible for COBRA coverage.

- A benefit is significantly curtailed, including curtailments resulting in a loss of coverage or an increase in deductible, co-pay or out-of-pocket amounts

- A benefit option is added or improved

Special Enrollment into a Cafeteria Plan

If an employee or their spouse and dependents initially decline group health insurance coverage during open enrollment but want to participate in the plan when certain circumstances occur, HIPAA allows them to under “special enrollment.” The following events can trigger HIPAA special enrollment rights.- Loss of eligibility for other group health coverage

- Termination of employer contributions toward other group health coverage

- Certain life events, including marriage, birth, adoption or placement for adoption

- Loss of coverage under a state Children’s Health Insurance Program (CHIP) or Medicaid

- Determination of eligibility for premium assistance under CHIP or Medicaid.